HOLLY ENERGY PARTNERS, L P. : HEP Stock Price US4357631070

Contents:

- HollyFrontier Q1 net and revenue doubled

- Wall Street Analysts Are Bullish on Top Industrial Goods Picks

- Holly Energy Partners, L.P. Third Quarter 2022 Earnings Release and Conference Webcast

- Holly Energy Partners MarketRank™ Forecast

- Holly Energy Partners’s Earnings Outlook

- HF Sinclair Corporation First Quarter 2022 Earnings Release and Conference Webcast

The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. The Zacks Industry Rank assigns a rating to each of the 265 X Industries based on their average Zacks Rank. Investors need to pay close attention to Holly Energy Partners stock based on the movements in the options market lately.

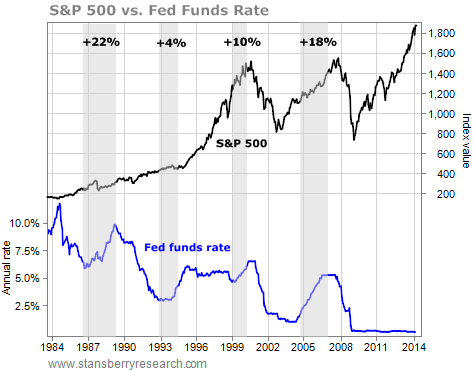

- Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year.

- A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares.

- Only 8 people have searched for HEP on MarketBeat in the last 30 days.

- Real-time analyst ratings, insider transactions, earnings data, and more.

- It allows the user to better focus on the stocks that are the best fit for his or her personal trading style.

- The company was founded in 2004 and is based in Dallas, Texas.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Intraday Data provided by FACTSET and subject to terms of use. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements.

Of note is the ratio of HOLLY ENERGY PARTNERS LP’s sales and general administrative expense to its total operating expenses; merely 5.37% of US stocks have a lower such ratio. Reported Q3 EPS of $0.33, $0.17 worse than the analyst estimate of $0.50. Revenue for the quarter came in at $149 million versus the consensus estimate of… Represents the company’s profit divided by the outstanding shares of its common stock. Expro Group Holdings saw its shares surge in the last session with trading volume being higher than average.

View analysts price targets for HEP or view top-rated stocks among Wall Street analysts. Holly Energy Partners LP share price live 16.66, this page displays NYSE HEP stock exchange data. View the HEP premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Holly Energy Partners LP real time stock price chart below.

HollyFrontier Q1 net and revenue doubled

That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

According to 2 analysts, the average rating for HEP stock is “Buy.” The 12-month stock price forecast is $21.0, which is an increase of 26.05% from the latest price. A valuation method that multiplies the price of a company’s stock by the total number of outstanding shares. Money Flow Uptick/Downtick RatioMoney flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades.

The technique has proven to be very useful for finding positive surprises. In fact, when combining a https://1investing.in/ Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Matt Clifton has an approval rating of 100% among the company’s employees. This puts Matt Clifton in the top 10% of approval ratings compared to other CEOs of publicly-traded companies. Holly Energy Partners’ stock was trading at $18.12 at the beginning of the year. Since then, HEP shares have decreased by 8.1% and is now trading at $16.66. According to analysts’ consensus price target of $19.67, Holly Energy Partners has a forecasted upside of 18.0% from its current price of $16.66.

Wall Street Analysts Are Bullish on Top Industrial Goods Picks

Below are the latest news stories about HOLLY ENERGY PARTNERS LP that investors may wish to consider to help them evaluate HEP as an investment opportunity. The “Quality” component of the POWR Ratings focuses on 31 different factors of a companies fundamentals and operational strength. Here are some key insights as we drill into the specifics of these quality attributes.HEP has a Quality Grade of B, ranking ahead of 88.21% of graded US stocks. Stocks with similar financial metrics, market capitalization, and price volatility to HOLLY ENERGY PARTNERS LP are SVC, MAC, GTN, RTL, and DLNG. There may be delays, omissions, or inaccuracies in the Information. HollyFrontier Corp.’s HFC first-quarter earnings more than doubled as the independent petroleum refiner continues to benefit from last year’s merger.

The company is scheduled to release its next quarterly earnings announcement on Thursday, May 4th 2023. Sign-up to receive the latest news and ratings for Holly Energy Partners and its competitors with MarketBeat’s FREE daily newsletter. In the past three months, Holly Energy Partners insiders have not sold or bought any company stock. Only 8 people have searched for HEP on MarketBeat in the last 30 days. Based on earnings estimates, Holly Energy Partners will have a dividend payout ratio of 61.67% next year.

Holly Energy Partners, L.P. Third Quarter 2022 Earnings Release and Conference Webcast

KSU, BKNG, and LUV are the stocks whose asset turnover ratios are most correlated with HEP. Over the past 33 months, HEP’s revenue has gone down $9,314,000.The table below shows HEP’s growth in key financial areas . HEP scores best on the Momentum dimension, with a Momentum rank ahead of 91.13% of US stocks. We have 9 different ratings for every stock to help you appreciate its future potential. If you’ve had to fill up your gas tank or heat your home lately , you might have noticed that your wallet is a lot lighter than usual. Master limited partnerships, otherwise known as MLPs, are appealing for income investors.

Investing.com – Holly Energy Partners LP reported on Monday third quarter erl ||earnings that missed analysts’ forecasts and revenue that topped expectations. Provides petroleum product and crude oil transportation, terminalling, storage, and throughput services to the petroleum industry in the United States. It operates through two segments, Pipelines and Terminals, and Refinery Processing Unit.

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Holly Energy Partners owns and operates petroleum product and crude pipelines, storage tanks, distribution terminals, and loading rack facilities. The company was founded in 2004 and is based in Dallas, Texas.

Holly Energy Partners MarketRank™ Forecast

The dividend payout ratio of Holly Energy Partners is 79.10%. Payout ratios above 75% are not desirable because they may not be sustainable. Holly Energy Partners has received no research coverage in the past 90 days.

options delta investing classes Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price.

The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Measures how much net income or profit is generated as a percentage of revenue.

This indicates that Holly Energy Partners will be able to sustain or increase its dividend. Holly Energy Partners has a short interest ratio (“days to cover”) of 7.7. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. The year over year net income to common stockholders growth rate now stands at -4.72%.

HollyFrontier–which was formed in July through the merger of Holly Corp… Holly Energy Partners announced a quarterly dividend on Thursday, April 20th. Investors of record on Monday, May 1st will be paid a dividend of $0.35 per share on Thursday, May 11th. This represents a $1.40 dividend on an annualized basis and a yield of 8.40%. The P/E ratio of Holly Energy Partners is 9.41, which means that it is trading at a less expensive P/E ratio than the Oils/Energy sector average P/E ratio of about 55.68. News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

Union minister assesses progress on mega Projects under NHPC, NHIDCL in Doda Mint – Mint

Union minister assesses progress on mega Projects under NHPC, NHIDCL in Doda Mint.

Posted: Sat, 11 Mar 2023 08:00:00 GMT [source]

Upgrade to MarketBeat All Access to add more stocks to your watchlist. One share of HEP stock can currently be purchased for approximately $16.66. 5 people have added Holly Energy Partners to their MarketBeat watchlist in the last 30 days. This is an increase of 400% compared to the previous 30 days. MarketBeat has tracked 3 news articles for Holly Energy Partners this week, compared to 1 article on an average week.

Croatia to guarantee 1 bln euro loans to state-owned HEP for … – SeeNews

Croatia to guarantee 1 bln euro loans to state-owned HEP for ….

Posted: Mon, 06 Jun 2022 07:00:00 GMT [source]

HEP’s EV/EBIT ratio has moved down 149.6 over the prior 229 months. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world. In 2022, HEP’s revenue was $547.48 million, an increase of 10.71% compared to the previous year’s $494.50 million. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries.

The latest trend in earnings estimate revisions could translate into further price increase in the near te… © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.